How To Opening a Bank Account in Costa Rica as an Expat

Ever thought about how easy it is for expats to open a bank account in Costa Rica? Many newcomers find it hard to navigate the banking system here. This guide, with over 20 years of local knowledge, aims to clear up the confusion.

It covers everything from who can open an account to the types of accounts available. You’ll learn about the documents needed and how to choose the best bank for expats. This is key for managing your money, from everyday expenses to big purchases like property.

Key Takeaways

- The process of opening a bank account in Costa Rica may be time-consuming for expats.

- State-owned banks provide stability, while popular private banks offer modern services.

- Understanding residency and account types is crucial for effective financial management.

- Initial deposits range from $25 to $100, varying among different banks.

- Engaging with escrow accounts is advisable for significant transactions.

- Expert accounting services can help ensure compliance with local regulations.

Understanding the Costa Rican Banking System

The costa rica banking system is known for strict rules to fight financial crimes. It helps both locals and expats with a wide range of banking services. Knowing the different banks in Costa Rica is key for anyone looking to open an account.

Types of Banks in Costa Rica

Costa Rica has many banking types, each with its own role. The main ones are:

- State-owned banks: Banco Nacional de Costa Rica and Banco de Costa Rica offer many services with government backing.

- Private banks: Banks like BAC Credomatic and Scotiabank de Costa Rica provide personalized services for locals and foreigners.

- Cooperative banks: Banco Popular y de Desarrollo Comunal focuses on helping small communities grow socially and economically.

Public vs. Private Banks

Public banks in Costa Rica are known for their reliability because of their government ties. They offer basic banking services and have many branches. Private banks, on the other hand, offer more flexibility and tailored services. They are great for expats looking for expat banking options costa rica.

International Banking Options

Expats in Costa Rica can find international banking options. These banks have strong online services and help with currency exchange. Even though they might have strict rules, they are good for expats who want easy banking while living in Costa Rica.

Can Expats Open a Bank Account in Costa Rica

Expats can open a bank account in Costa Rica, but rules vary by bank. Knowing what you need to open an account makes it easier. Some banks, like Banco de Costa Rica (BCR), let non-residents have accounts with certain limits. This helps attract expats to use their banking services.

Eligibility for Expats

Each bank has its own rules for expats. For example, Banco de Costa Rica lets non-residents have accounts with a $1,200 monthly limit. But, other banks might require you to prove you live there legally. Knowing these rules helps expats find the right banking solutions.

Account Types and Restrictions

Expats can choose from different accounts, like savings or dual currency ones. These accounts let you manage money in both Costa Rican colones and US dollars. But, each bank has its own rules, like limits on how much you can do each month or fees to keep the account open.

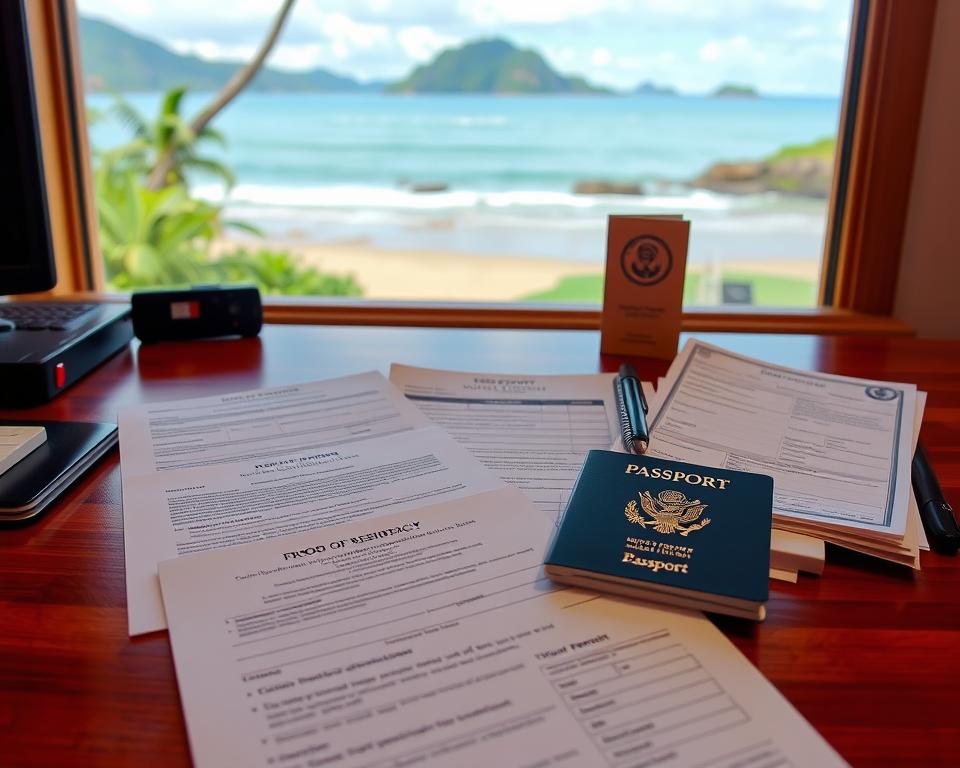

Proof of Residency and Identification

To open an account, expats need to show certain documents. You’ll need proof you live there and a valid ID, like a passport. Knowing what documents you need helps you get through the banking process in Costa Rica.

Requirements for Opening a Bank Account

Opening a bank account in Costa Rica can be challenging for expats. This is due to various bank account requirements for expats in Costa Rica. It’s important to know the necessary documents and policies for a smooth experience.

Essential Documents Needed

Expats need to gather important documents for a bank account. These include:

- A valid passport

- Proof of address (such as a utility bill)

- Tax identification number

- In some cases, proof of income or funds

Recent laws to prevent money laundering may require more documents. For example, U.S. citizens might need to fill out FATCA forms.

Minimum Deposit and Fees

The minimum deposit for a bank account in Costa Rica varies. It’s usually between $25 to $100. It’s crucial to ask about fees, like monthly charges or fees for international transfers. Knowing these costs can avoid surprises.

Understanding Specific Bank Policies

Every bank in Costa Rica has its own rules for managing accounts. Some may accept electronic signatures, while others require you to be there in person. Banks also watch transactions closely. If something looks unusual, they might ask for proof of where the money came from.

Best Banking Options for Expats in Costa Rica

Choosing the right bank is key for expats in Costa Rica. Knowing the banking options can make managing money easier. The country has state banks, private banks, and international banks, each meeting different needs.

Top State-Owned Banks

State banks like Banco Nacional and Banco de Costa Rica are top choices. They are stable and have a wide network. Expats like them for their security and many services.

These banks are easy to find, with lots of ATMs and lower fees. In 2016, Banco de Costa Rica let non-resident foreigners open accounts. This made it easier for expats to handle their money.

Popular Private Banking Institutions

Private banks like Scotiabank and Banco BAC San Jose offer personal service. They have bilingual staff, which is great for expats. These banks might have fewer branches and ATMs than state banks.

Opening an account can have its rules. Knowing these rules is important for a good banking experience.

International Banks in Costa Rica

International banks like Bank of America are also in Costa Rica. They are good for expats who want to manage accounts in other currencies. But, opening an account might be harder.

Expats should think about where to bank. Look at branch locations, language support, fees, and services. For more on moving abroad and banking in Costa Rica, check out this resource.

Conclusion

Understanding how to open a bank account in Costa Rica is key for a smooth financial start in a new country. The banking system in Costa Rica includes state-owned and private banks. Each offers different services to meet various needs.

Expats should know what documents are needed and the rules of each bank. This knowledge helps in choosing the best bank for their needs. Whether it’s a state bank for stability or a private bank for personal service, research is important.

Opening a bank account abroad is more than just having money. It’s about finding a bank that fits your needs. With the right information, expats can manage their money well. This makes moving to Costa Rica easier.

Starting a new life in Costa Rica means managing your finances well. Knowing how to navigate the banking system is essential. With the right knowledge, expats can make good choices and enjoy their time in this lively country.